How to manage an innovation funnel? (part 1)

A short while ago, I had a coffee chat with the Chief Digital Officer of an ASX100 consumer goods company who is currently leading the digital transformation of a product-based company into the digital world.

She resonated with the rigor that Strategyzer brings to the innovation practice, and was curious to learn more about how we help Global 500 companies manage their innovation portfolio.

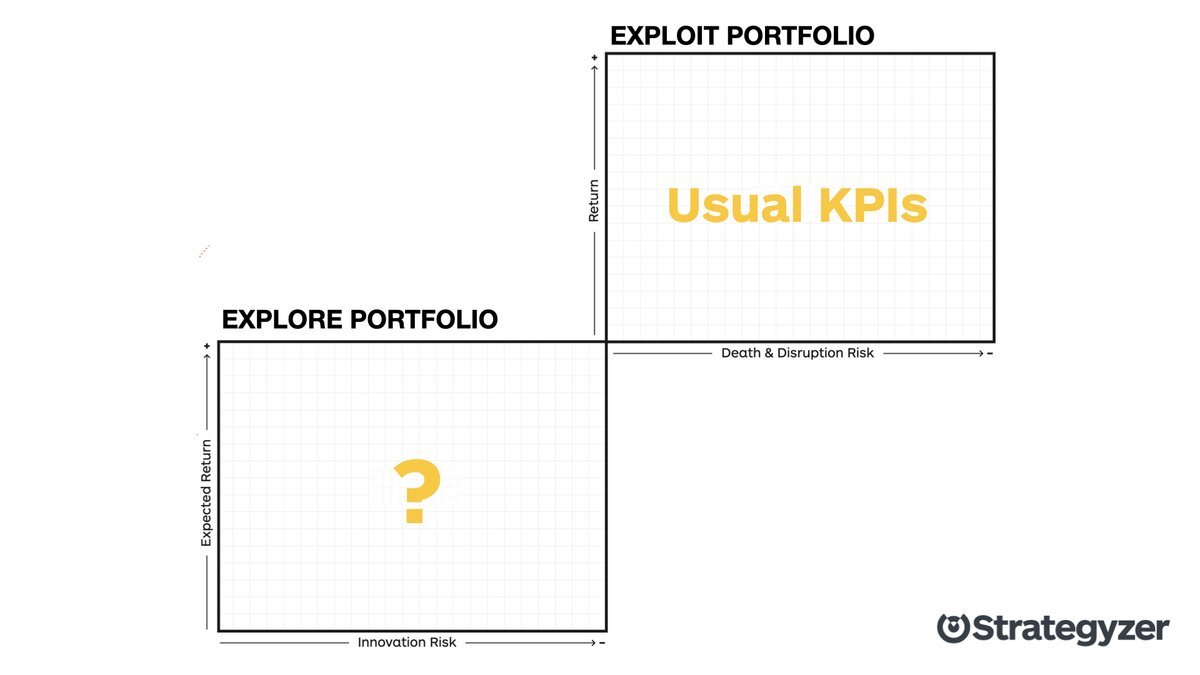

We started by discussing the Explore and Exploit continuum and why managing an innovation portfolio (Explore) is different from managing a typical technology project portfolio for instance (Exploit). And the first key difference is uncertainty.

Uncertainty

We discussed how her digital transformation initiatives could be placed on a spectrum from relatively low uncertainty (e.g. digitizing a paper process in existing operations) to high uncertainty (e.g. using available data to build completely new products and services).

Traditional methods involving the creation of a business plan and then execution of the plan would work well on her digital projects where uncertainty is low. But new business ideas with high uncertainty cannot be managed the same way. For those, adopting a portfolio approach is highly recommended.

That lead us to discuss the second difference. Managing an innovation portfolio is a volume game.

A volume game

It’s fundamentally different from managing the carefully curated and limited list of projects in a typical technology portfolio. To illustrate this point, I used data points from the venture capital world: if an entire industry loses money on two thirds of their investments, it is delusional to think that corporate executives could “pick the winners” from the start and successfully lead their new digital business ideas all the way to market.

To create a new sustainable business, a company has to let a lot of ideas enter its innovation funnel and make small investments in them. In the chart we extrapolate on the VC data to show that a company whose objective is to create a new business with a 50x return would need to invest in 250 early-stage initiatives.

Source: adapted from Correlation Ventures

The third difference we discussed then is that managing an innovation portfolio requires killing the vast majority of ideas, initiatives and projects along the way.

Killing most projects

That’s not something leaders in large organizations are used to. On a typical technology project portfolio, once executives have approved a project, they expect it to go all the way to completion. Most leaders will use their power and influence to help the project team achieve project objectives. Yet managing an innovation portfolio requires sorting through a large volume of innovation options. Here, leaders need to display a different behaviour and make different types of decision, the most common being to “kill” a project.

Leaders in large organizations need to act more like Venture Capitalists when it comes to managing their innovation portfolio. Only ideas, initiatives and projects that are quickly able to show potential and progress should be kept in the portfolio.

A quick recap on key specificities of managing an innovation funnel that leaders should be aware of:

Manage ideas with high uncertainty with a portfolio approach.

Play the volume game: make lots of small investments at the beginning!

Kill the vast majority of ideas, initiatives, projects on your portfolio

In the second part of this blog post I will summarise the rest of our discussion on process, governance and funding principles to manage an innovation portfolio successfully.